TimeMoney World

Time, Money and Growth

Fund Accumulation

The Effect of Different Rates of Interest

Here you can see how a fund of 1,000.00 (any currency) is accumulated over a period of 5 years at different yearly interest rates, if the yearly interest is added to the capital at the end of each year, as it would be in a sinking fund, or a savings scheme with regular saving deposits.

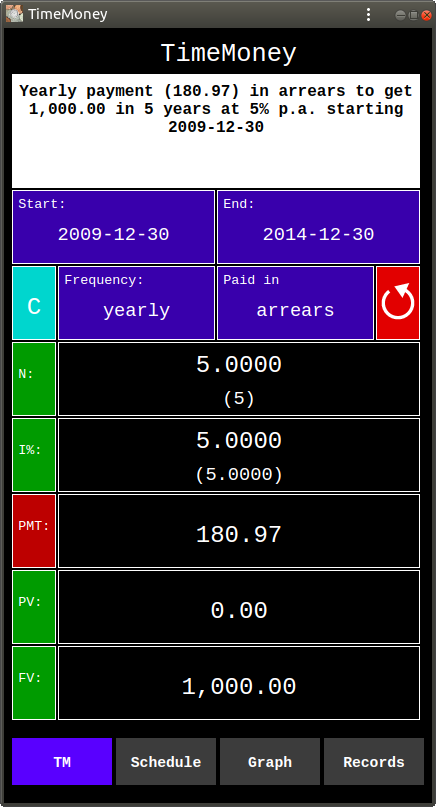

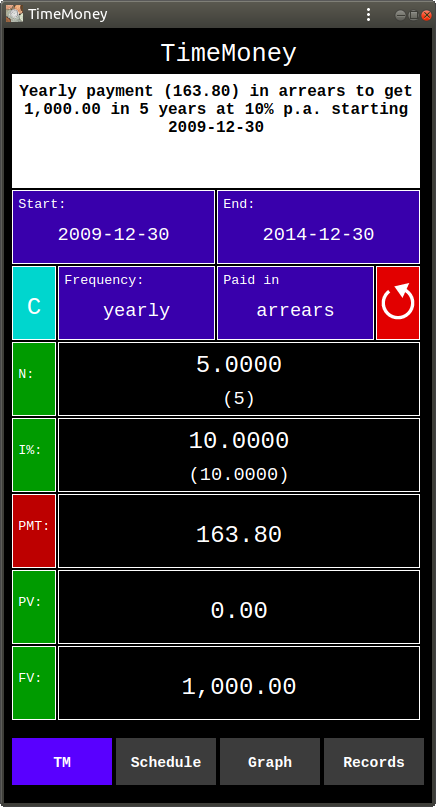

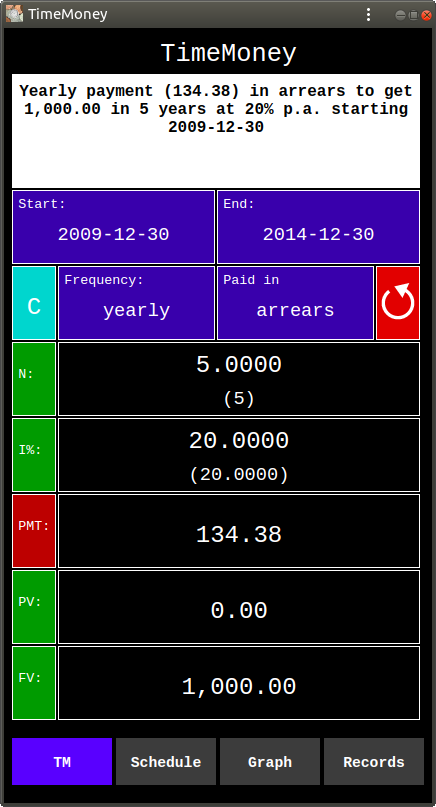

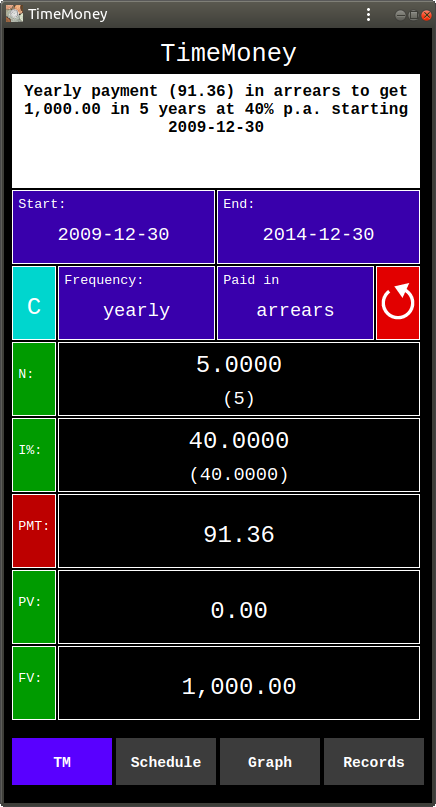

Above are the computations of the Payment (PMT), required to accumulate a fund of 1,000.00 (FV) by 24 February2015, starting on 24 February 2010 (in 5 years), at different annual (yearly) rates of growth (i%): 5%, 10%, 20%, 40%.

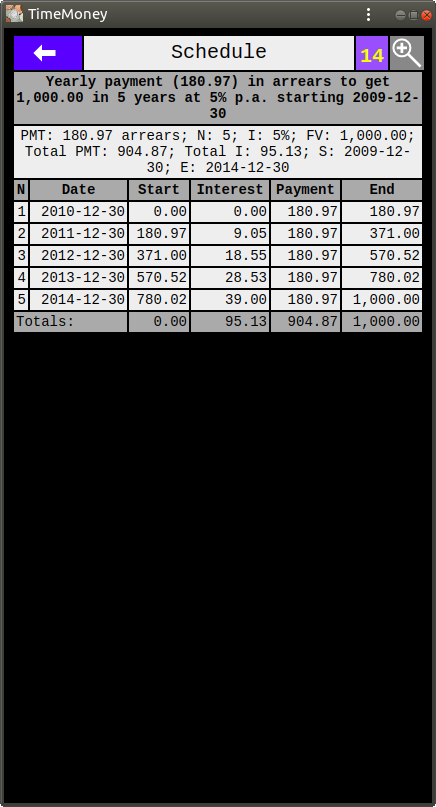

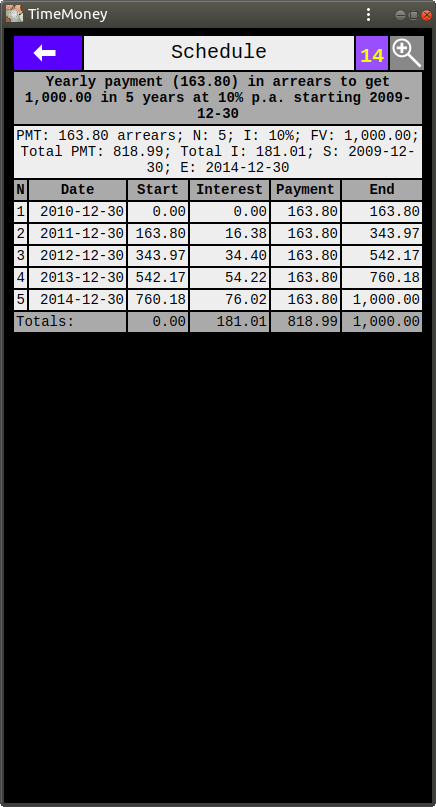

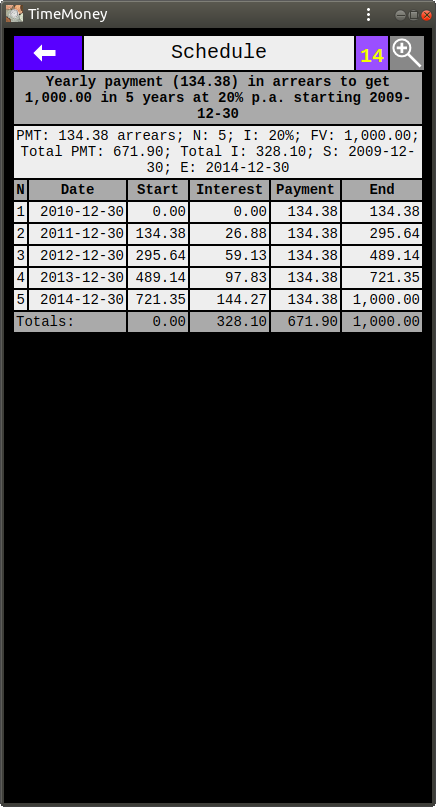

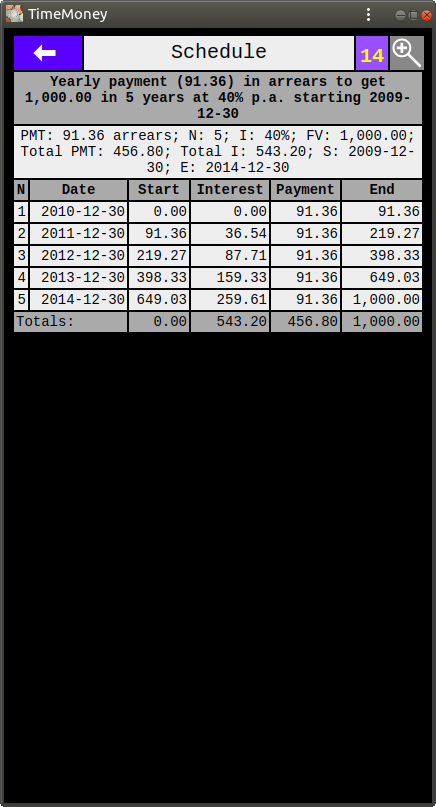

Above are the fund accumulation schedules of the above computations.

The schedules show the accumulation of the capital within each of the 5 years (compounding periods).

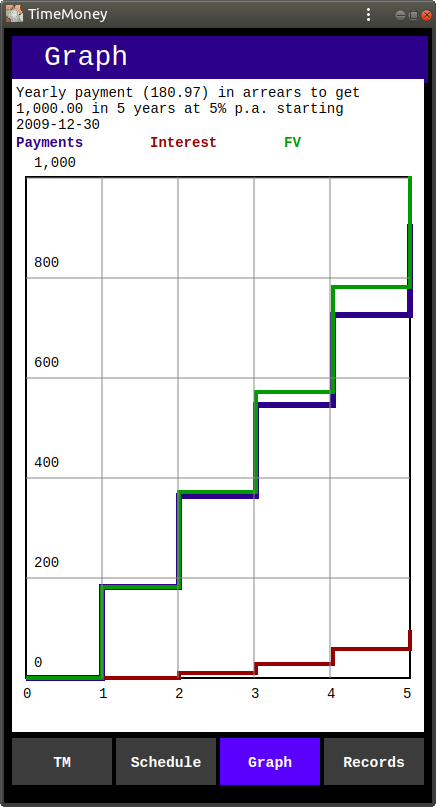

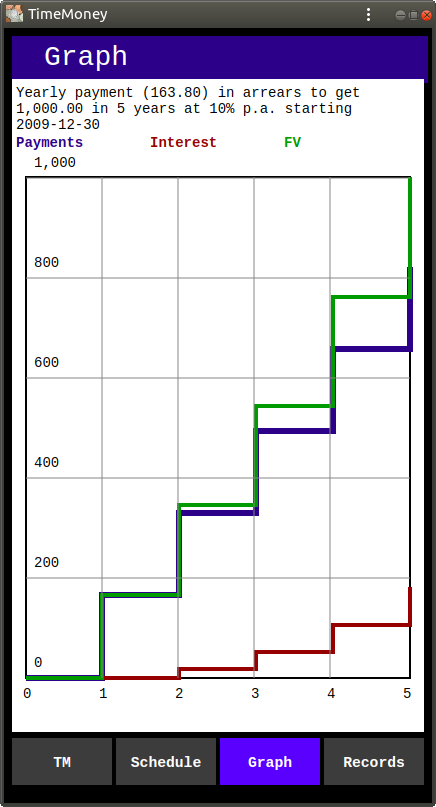

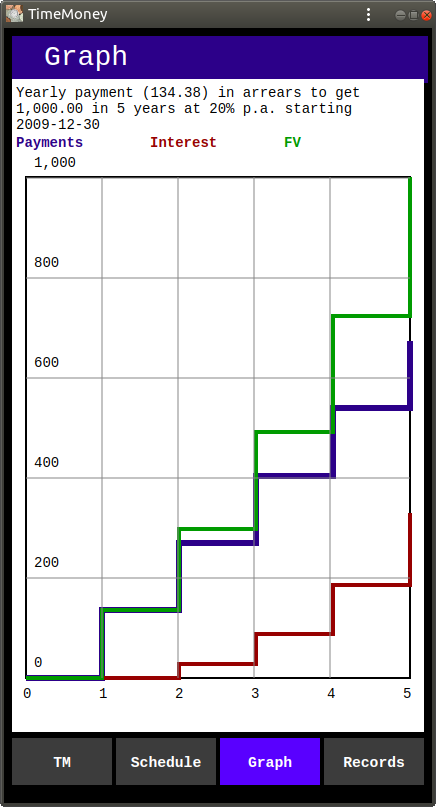

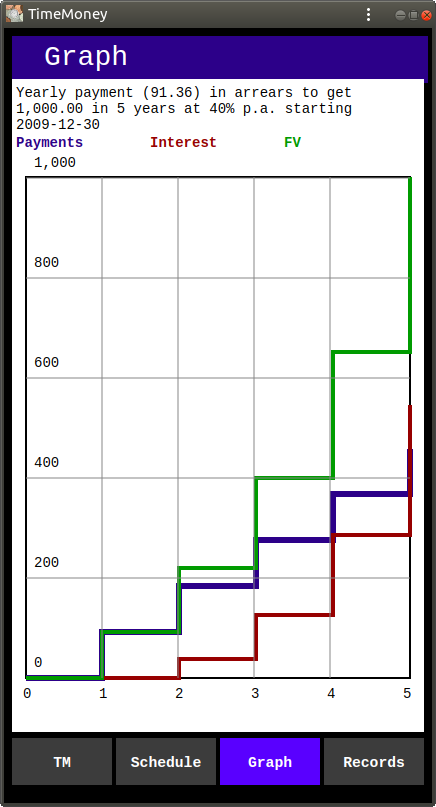

Above are the graphs of the above computations.

The graphs show the accumulation of the capital within each of the 5 years (compounding periods).

The green line in the graphs is the Fund Capital (Future Value). The red line is the total Interest received at the end of each period. The blue line is the total of the capital contributions made.

Looking at the graphs side by side, one can see that with the increase of the growth rate the part of the fund contributions due to interest (under the red line) becomes progressively greater than the part of the fund capital due to capital contributions (under the blue line). This affects the total cost of the fund.

Thus at 5% interest rate the cost of the fund is 904.87 (that is 90% of the fund), while at 40% interest the cost of the fund is reduced to 543.20 (that is 54.32% of the fund).

The formula for Fund Payment (PMT) is:

PMT = FV * r / ((1 + r) n - 1)

Where:

FV is Future Value,

r is the yearly interest, as a fraction (i / 100)

n is number of years.

The above computations, schedules, and graphs were performed using TimeMoney by Dalasoft Ltd.

TimeMoney app is a universal Progressive Web Application (PWA) which works on any device (phone, tablet, desktop) on any operating system from your browser, as long as it supports modern JavaScript. And, if you install it on your device, you will be able to start it by clicking its badge on your Home Screen, like any other app on your device.

TimeMoney app is FREE. It has no ads and does not collect any data.

To try it out, use this link: TimeMoney .